At a glance

- YYC Group serves clients across Kuala Lumpur, Selangor, Penang, Johor and Singapore.

- Diversify, digitalise and grow seems to be YYC Group’s motto. It now has its own business school and global accounting services.

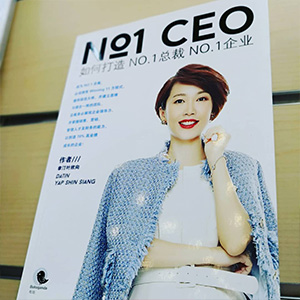

- Datin Yap Shin Siang FCPA, YYC’s CEO, estimates the firm is already in the top 10 accountancy firms by size, and can rival the Big Four locally.

If you’re ever doing business in Malaysia, look for the odd one out. There, in a business journal, on a conference panel or in the business pages of a newspaper, you’ll likely spot a single female face amid a sea of males.

Chances are, this will be the face of Datin Yap Shin Siang FCPA, CEO of YYC Group, one of Malaysia’s premier home-grown tax and business advisory firms, and arguably the face of entrepreneurialism in Malaysia’s small business sector.

When asked how it feels to be one of a small number of female accountancy CEOs in Malaysia, she makes light of the question. “I know I’ll never be one of the boys,” she laughs. “But I was never going to be a very good housewife either.”

Yap has become a brand ambassador not just for her company, but also for the accountancy/consultancy profession as a whole. Tellingly, she was popular with the media in late 2015 and throughout 2016 when Malaysia introduced a goods and services tax (GST).

To many small businesses, the new GST felt like a foreign impost foisted on an unwary and unprepared business community. Yap estimated that about 80 per cent of small businesses were getting it wrong and misfiling.

"We want to be the world-class accounting and advisory firm in Asia. When people come to Asia, I want them to come to us."

In a climate of confusion, Yap offered a reassuring touch. Thrust into the social media, press and television limelight, her role was that of corporate nerve-calmer.

Perhaps she was destined for this role. Her father, Yap Seong Fatt, would do company accounts at the kitchen table when she was a small girl, so she knew nothing else.

In the early 1990s she attended Presbyterian Ladies’ College (PLC) in Melbourne. The PLC school career adviser couldn’t quite believe this 16-year-old girl had already mapped out her career path.

“My dad told me accountancy would be quite respected and you can earn a lot of money. I have since found that none of this is true,” she laughs.

Yap completed a commerce degree at Melbourne University, and by the late 1990s had a job with Arthur Anderson. A year later, she hopped over to KPMG. At that stage it was a fairly normal progression for a recently graduated accountancy student.

Things changed when Seong Fatt had a serious accident and was injured for some time.

“My dad asked me to join the firm [in 2000], but I was reluctant – I am a shy person, but I was the elder sister and I had to lend a hand.”

Her younger brother Yap Zhi Chau FCPA (now YYC group executive chairman) could not yet be called on, as he was still at university.

Standing alongside a tall tale

She drew inspiration from the legendary Chinese character Mulan, an ancient Chinese tale introduced to Western audiences with Disney’s 1998 animated feature. “According to legend, she disguised herself as a male to take her father’s place in the army to go to war. I felt I was doing the same thing,” Yap says.

Mulan, possibly more myth than truth, has become China’s version of the British warrior queen Boudica. Disney is scheduled to release a live-action version of the Chinese legend later this year.

When Yap arrived at her father’s firm in 2000, she was 24. At that stage, there was a smattering of clients who had been there for decades, and 30 staff in total.

The furniture had never been changed; the style and decor remained stuck in a mid-1970s time warp. There was not a computer to be seen. Attempts by her and her brother to modernise the company mostly resulted in inter-generational warfare.

“It took us some time, but we eventually wore my dad down,” she laughs.

Fast-forward 20 years and the firm has numerous branches, about 20,000 clients – and modern furniture suites in each location. There are 800 personnel. It now touts itself as a multi-business advisory firm, with an eye on listing in the next four to five years.

What happened to her father Seong Fatt? “We simply replaced him,” she deadpans. “He now does most of the chauffeuring of my kids.”

She and Chau did not formally take over until about 2012, but their roles were always clear. Chau would be the thinker and strategic planner; Yap would be advice purveyor and public face of the company.

The key, they believed, was not about thinking big, but thinking small. SMEs were always the target.

Opportunity grants

Only a few months ago she was telling her clients – and the wider business community – that they must step up to the digital world. It was a case of be quick while stocks last.

The government was offering matching grants of up to RM5000 (US$1200) per company to adopt the latest digitalisation measures, such as electronic point-of-sale systems, enterprise resource planning and electronic payroll systems.

“It’s only for the first 100,000 SMEs,” she told them.

Similarly, there is the smart automation matching grant of RM2 million (US$477,782) per company only available to 1000 manufacturing and 1000 service companies to invest in automating their business processes.

Yap estimates that there are about a million small businesses in Malaysia. If you want to be a client, she says, you must prove your willingness (like YYC itself ) to grow.

“We think that only 10 per cent of that million or so businesses have a real growth attitude,” she says.

She and Chau have grown the business both through acquisition and organic growth. The firm proudly states that it has tripled its revenues since 2016.

In 2017, it opened a business school. The following year it opened a branch in Penang, and one in Singapore last year. YYC has now consolidated into eight branches, based in Kuala Lumpur, Selangor, Penang, Johor and Singapore.

A woman's worth

How has she been perceived by her male counterparts?

“There are men who think that a woman CEO must be very intimidating – that she must be some kind of iron lady,” she says, with a laugh.

Yap’s style is one of appealing to people’s hearts, and rather than having a grand social media strategy, she has found the media coming to her rather than the reverse.

Yet maintaining the brand ambassador appearance and face of a high-profile business advisory firm is a task that must be constantly worked at.

“I realised it’s OK to be vulnerable and to say sorry and to be wrong. And I have made sure I am always listening to young people,” Yap says.

After extensive travel, she and her brother adopted a US-based strategic planning system that reflects their experiences working in China, the US and Australia.

“We’re now helping other businesses to take up our system,” she says. “It’s part of what we offer our clients.”

Making the clients be like them has worked for the group, but the next stage could easily be very different.

The YYC Group is taking a corporate leap onto the stock exchange in the next few years that will change its status from a home-grown, home-spun family business.

The big buy in

At YYC Group’s 45th anniversary celebrations last year, she told all those assembled that to get to the next level, they would have to find a larger partner. OCBC Bank is slated to take less than a 20 per cent stake – Yap does not disclose the exact number.

It is a Singaporean bank, not a local one. Why OCBC? There are plenty of synergies, she says.

“We had a few suitors, but OCBC has the same mindset. It is looking to give its best to its clients, and that’s the kind of strategic partner we need – one who is trustworthy.”

Yap gives the strong impression that her firm is an exemplar, and that where YYC leads, clients should follow. Diversify, digitalise and grow seems to be the motto. YYC now has its own business school and global accounting service, and has its own HR and cloud computing entities.

“I always felt that just doing compliance would not be holistic enough. It doesn’t by itself help the business owner to expand and invest,” she says.

She estimates the firm is already in the top 10 accountancy firms by size in Malaysia, and sees no reason why they can’t be the largest and as influential as any of the Big Four locally.

“We want to be the world-class accounting and advisory firm in Asia. When people come to Asia, I want them to come to us,” Yap says.

“I have enormous ambition. I’m 44 years old and still want to be more effective.”