At a glance

Why you should diversify your portfolio

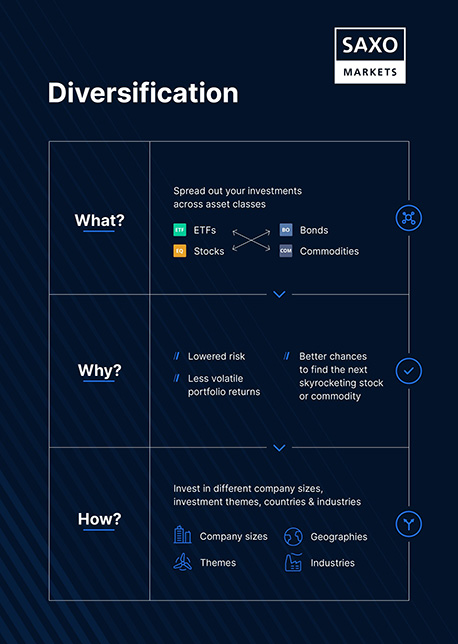

When diversifying your portfolio, your total investment nest egg isn’t weighted too heavily upon one thing – if your favourite tech stocks suddenly become volatile or the ASX takes a dramatic downturn, your portfolio as a whole could be vulnerable.

Less risk is just one benefit of diversification. Casting your investing net wider – across the globe if possible – also means you’ll be able to catch more growth opportunities.

Holding a well-diversified portfolio usually also leads to less volatile returns. A broader range of investments across global markets tends to generate a smoother return over time.

How to build a diversified portfolio and identifying what to invest in

As a starting point, consider holding a mix of various asset classes – stocks, commodities and more. Gain further diversification by picking different types of investments within the chosen asset classes.

One way of doing this is to filter investments based on different criteria. With Saxo, you can find individual investments based on geography, industry, issue and market capitalisation.

Another way of building a diversified portfolio is to apply a thematic investment approach, where you start by picking a few themes or long-term market trends. In Saxo’s award-winning trading platform, you can find a pool of themes handpicked for future upside potential.

The themes range from energy to digitalisation and come with inspirational investment lists, giving you a well-diversified exposure.

If you prefer to “buy the entire theme” over investing in single instruments, the exchange traded funds (ETFs) give you instant diversification.

What is the ideal number of investments?

While there are different opinions about the optimal number of investments in a diversified portfolio, there is no correct answer to this question. However, most investors hold at least 15 to 20 instruments.

See how you can save more with Saxo. Stock and ETF brokerage on the ASX is just A$5, and NASDAQ NYSE from US$3. With greater choice, you can diversify your investment and save more on the costs with Saxo.

About Saxo Markets Australia

Founded in 1992, Saxo Bank was one of the first financial institutions to develop an online trading platform that provided private investors with the same tools and market access as professional traders, large institutions and fund managers.

Saxo Markets Australia Limited is the subsidiary of Saxo Group, based in Sydney, Australia.

Saxo offers clients access to global capital markets across stocks, ETFs, bonds, options, contract for difference (CFDs) and foreign exchange. Trade more than 40,000 instruments in over 40 global exchanges from one account.

Saxo News & Research is provided for informational purposes. Trading can result in losses. Saxo Capital Markets (Australia) Limited (ABN 32 110 128 286 AFSL 280370).

Please refer to our PDS and TMD via home.saxo/en-au